US debt ceiling to be increased, yet again

The US debt ceiling has turned into a crisis, again, and many are of the view that this could be a partisan issue.A government shutdown is one of the likely consequences and a great a risk to all Americans.

There have previously been debt ceiling increases in the US, on multiple occasions, however, this time around we're looking at $31.4 trillion for the year 2023.

Is paying it back even possible?

The US national debt is of epic proportions, and by some accounts, even military personnel have said it's a threat to US national security and it risks a default making the nation bankrupt.

Will this happen?

The Republican led House of Representatives has passed a bill that would boost Washington’s $31.4 trillion fed debt ceiling, in exchange for slashing government spending, including programs championed by the Democratic President Joe Biden.

Passed by a party line vote of 217 to 215, with four Republicans breaking ranks, the bill now heads to the Democrat controlled Senate where it stands little chance of passing.

Biden has already threatened to veto the bill, which includes spending cuts that he previously called 'irresponsible'.

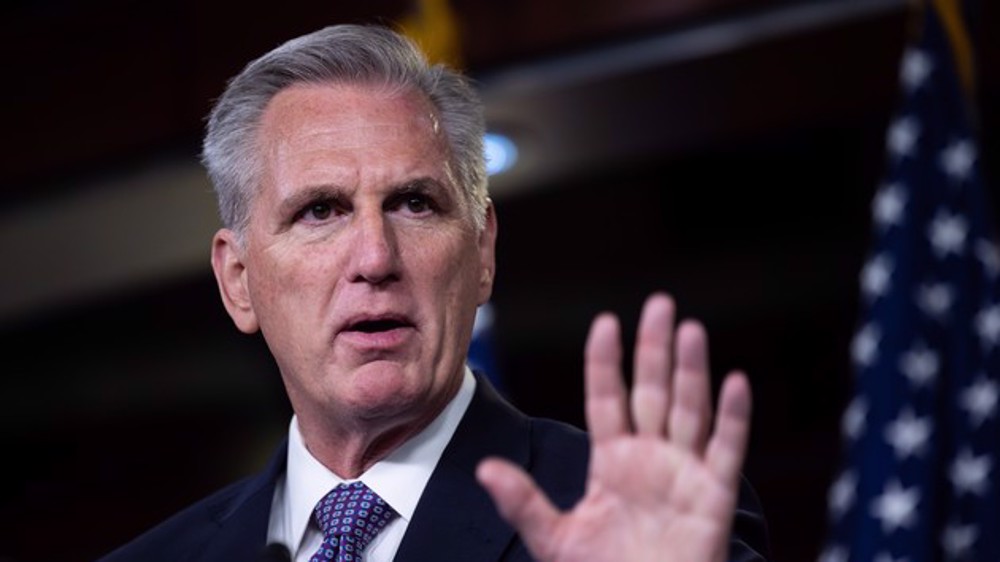

We've done our job. I've sat down with the president February 1st, he ignored it at the time. He treats it just like the border; he wants to ignore it, thinks it goes away.

That doesn't work in America.

He's putting the American economy in jeopardy by his lack of action. Now we should sit down and negotiate. We passed this early. We are in a... way ahead of the deadline.

We were the only party to take fiscal action in a sound manner that would lift the debt limit so we wouldn't have economic damage.

Kevin McCarthy, US Republican Party Leader

US Treasury Secretary, Janet Yellen, has warned that the failure by Congress to raise the government's debt ceiling and the resulting default would trigger an economic catastrophe.

The debt ceiling, also known as the debt limit, is the amount that the US can legally borrow to fulfill its financial obligations.

When it comes to the US national debt, the debt ceiling has been increased multiple times. Most recently it had been raised to $31.4 trillion in December 2021. The failure to raise the limit will see the US default.

Lifting the debt ceiling was once a fairly routine vote.

Since 1960, Congress has raised the ceiling 78 times; 49 times under Republican presidents and 29 times under Democratic presidents. The debt ceiling was last raised in 2021 to $31.4 trillion, where it currently stands.

The increases in recent years have come, not only from spending to combat COVID-19, and the wars in Afghanistan and Iraq, but also to cover the rising medical costs of an aging population and to fund all other services that government provides.

The US national debt has reached such epic proportions that it is said to be the biggest threat to US national security. At the same time, one of the biggest US spending is on its military, which is more than the next nine top spending countries combined.

Financial markets are becoming increasingly concerned about the standoff, sending the cost of ensuring exposure to US debt to its highest level in a decade, with financial analysts warning about the increasing risk of a default.

As total debt surpasses $31.4 trillion, the statutory limits, the Treasury is undertaking a series of bookkeeping maneuvers to disguise new borrowing and to keep the government operating.

This is a common scenario, when it comes to the debt ceiling, and it seems like a showdown between the main political parties.

Republicans have refused to increase the US debt ceiling, a limit on the amount of money Washington can borrow. And you obviously need to have the US president's consent for large spending cuts, which, obviously, he has so far refused to provide, which will hurt the average man in the street as as always

Why does the US find itself in this position, time and time again?

I think the ultimate reason, unfortunately, is that we have a 1789 constitution, a constitution that is now almost a quarter of a millennium old and we have adapted it for the 21st century.

And in American society today, that atmosphere of bipartisanship and statesmanship is breaking down and that is the real problem. It is breaking down.

You have to have cooperation to make the system work. The cooperation is not there on the Republican side of the moment.

Martin Sieff, Author & Political Analyst

It really should be very simple; you have a budget that gets passed, voted on, you have to act and spend according to that budget, but time and again, the US president or the administration goes beyond budget and reaches that limit.

It sounds like there's not much oversight but obviously there is, but, by design, it's moving forward that way.

What if the US can pay this huge debt of over $31 trillion and what would be the impact on the US economy?

Well, it's a very difficult issue. There really are two primary points. One is that the United States dollar is the world's reserve currency. Because so much of the world's trade is settled in dollars, It makes it somewhat of an essential currency at least for the time being, it may not retain that status, but as long as it does the United States can literally create a trillion dollars out of thin air.

Now, that can only go on for so long, but it may still be quite a while before that ends. Now the other part of the question you asked deals with, you know, does it ever reach a point where it simply can't be paid?

The more that you accumulate debt without having real production to back it up, the more seductive this becomes, and, and you see this constant ratcheting up and increase in debt.

And right now the debt is very, very high. And that exposes us to risks of inflation and it also puts pressure on the world's economy.

Richard H. Black, Former Virginia State Senator

The US government has hit its $31.4 trillion debt ceiling triggering fears of disastrous, if not catastrophic, fallout for Americans.

As the national debt has soared, the US Treasury Department has had to borrow more money to pay for government spending. The legislative curve on this borrowing is known as the debt ceiling. National Debt soaring is another way of describing government spending.

Then we move on to what the Treasury Department does, it spends the maximum amount authorized under the ceiling, but Congress must decide to suspend or to raise the limit on borrowing.

Irrespective of who's been in the White House, the US debt has increased dramatically.

As you progress from the year 1980 all the way through the year 2022, no matter who's been in office, the debt ceiling has increased.

In September 2021, the debt was at $28.5 trillion, then, it went all the way up to almost $31.5 trillion, which is where we currently stand and that is where, obviously, the US public debt is subject to its limit.

When you look at how the US national debt has increased multiple times over the years and decades, the most recent being $31.4 trillion December 2021 and January 2022.

Hasn't the US debt become so vast that they may never be able to pay it back, and if it defaults, what will be its impact on the US economy?

If there is a default it will be for the first time in US history. It will be devastating to America's credibility in the world. It will probably cause a crash on Wall Street such as we have not seen in almost a century, since 1929.

The results would be catastrophic, and it would throw the American economy and American society into chaos.

And, privately, a lot of Republicans realize this, but, publicly, they are cowards. The Republicans are not certain they can defeat him in 2024. So they want to discredit them politically.

And they also believe that if there is an economic recession, even if their policies cause it, before 2024 they can blame the president and the Democrats as the party in office for that happening.

So it's a very risky and irresponsible policy, it is not a national policy, It is not a patriotic policy in US terms, but they wanted to simply get back into power.

Martin Sieff, Author & Political Analyst

The US national debt, it has reached epic proportions. On the one hand, you have not only economists but also, more importantly, you have some army officials saying that that's the biggest threat to US national security.

Meanwhile, the US has spent so much on its military that it amounts to more than that spent by the next nine top spending countries combined. Could you please put that into perspective for us?

Yes, the United States’ military budget is gargantuan. We have a budget that is 12 times as much as Russia's military budget. Right now, the US spends three times as much as China.

Our military presence across the globe is clearly excessive.

What are we doing in the Middle East? Why do we have troops in the Middle East?

We didn't have that when I was a colonel in the Pentagon. Things were very calm and peaceful over there. And since then, we've had enormous military engagements there.

Richard H. Black, Former Virginia State Senator

If lawmakers don't raise the nation's borrowing limit by June, the federal government runs the risk of defaulting on its debt obligation which would be catastrophic for the economy, putting millions of jobs in jeopardy. Investors are demanding historically high yields for US Treasury notes which mature in July.

That is when the US will default on its debt if no legislative action is taken.

When yields on shorter term bonds exceed those of longer term bonds, it is often a sign that bad economic times are ahead.

On (the) one hand, it looks like the Fed can continue raising rates or at least raise debt in May, which is what the market is expecting and that's where the consensus view is.

On the other hand, of course, we have this banking crisis which is causing stress in the financial system and we are seeing signals that credit may be tightening.

So I think what is most likely to happen is that the Fed is going to raise the debt ceiling because that's also what they have been communicating for a while, indirectly. And, and then they're likely to pause and see how the inflation evolves, and whether we get the kind of decline in inflation that is expected, that the Fed is expecting.

I think the big disconnect right now in the market is that how long the Fed stays at current levels and how soon they are going to cut interest rates. And I think, to that extent, what the Fed is saying that [sic] no cuts in 2023 and stay at current high levels.

Geetu Sharma, Investment Manager

The last prolonged standoff over the national debt in 2011 led to a downgrade of the US credit rating which shook financial markets and raised borrowing costs.

Some Republicans say the current bill does not do enough to cut the deficit. In 2011 a debt ceiling standout led to credit rating agency Standard and Poor's downgrade of US debt from the highest possible status AAA to double A plus.

During the last fiscal year the federal government spent more on interest payments than Transportation, Housing, or, Food and Nutrition Services combined.

In the final quarter of 2022 the US paid a record $213 billion in interest, up from $63 billion during the same period the year before. It now seems that the US debt has reached a point where the United States of America could never pay it back.

35% of US debt is owned either by domestic or foreign investors, including foreign nations. An actual default would be much worse. Not only would the US likely be downgraded again, but government workers and social security recipients, and many others, would go unpaid.

Surpassing the debt ceiling is another way of saying I have spent too much and, hence, I need more money.

As careless and incompetent as that may sound, the US has, time and again, breached its debt limit.

And here are some more facts on the repercussions.

A downgrade by credit rating agencies is not far off the mark, since it is something that has happened before.

This incurs increased borrowing costs for businesses and homeowners, consumer confidence gets impacted negatively, which could spiral the economy into recession.

A default on our debt would produce an economic and financial catastrophe; many of your residents could ultimately lose their jobs.

Household payments on mortgages, auto loans, and, credit cards, would rise and American businesses would see credit markets deteriorate.

Janet Yellen, US Treasury Secretay

Goldman Sachs has a more dire prediction of what would happen if the debt limit is breached. It said it would halt about 1/10 of US economic activity.

If that happened it would cause the loss of 3 million jobs then comes the impact on interest rates, which would be catastrophic, raising the national debt by $850 billion. This would divert taxpayer money away from things like infrastructure, education, and, healthcare.

One wonders, could breaching the US debt ceiling bring down other markets?

At first the standing of the US dollar would take a severe hit impacting global financial markets.

The credit worthiness of US Treasury securities has long bolstered demand for the US dollar, contributing to its value and status as the world's reserve currency.

Any hit to confidence in the US economy, whether from default or the uncertainty surrounding it, would cause investors to sell US treasury bonds and thus weaken the dollar.

The US House Speaker, Kevin McCarthy, has said that the US President, Joe Biden, should "sit down and negotiate".

This came after the house passed the debt ceiling bill, which would raise the national borrowing limit but it's only in conjunction with drastic spending cuts.

The main issue is not that but why the US creates money without any backing to cover spending that wasn't in the budget in the first place.

While subjecting Americans, and even global financial markets, to US political party wrangling.

US, not Iran, began attacking civilian infrastructure, Araghchi warns

Iran slams attacks on civilian airports as ‘another wicked chapter’ in US-Israel terror

US lawmakers, legal experts: Trump administration waging illegal war on Iran

US worried over dwindling ammunition stocks in war against Iran: Report

Blinded giant: How Iran crippled America’s multi-billion dollar THAAD network in days

Iran says 82 US or Israeli drones shot down since war began

Any point of aggression against Iran ‘a legitimate target’: Armed forces spokesman

220 US forces killed or wounded in Iranian strikes in 24 hours

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website