The end of US dollar hegemony draws near

The days of US dollar hegemony appear to be numbered as multiple countries have adopted alternative currencies to the US dollar for international transactions.

The US Dollar's position as the primary global reserve currency is being challenged. This is because several countries have started to ditch dependency on the dollar and strengthen bilateral relations.

This is a trend that is known as de-dollarization.

The Kingdom of the dollar shrinks

According to the IMF, the dollar weighted foreign exchange reserves has fallen to around 60%, a relatively low level, over past few decades, and the trend is accelerating.

There are a number of reasons for this. Let's start with the most pressing issue of the day, the war in Ukraine.

What is the role of the Russia Ukraine war on this trend?

The reactions from Western countries through sanctions demonstrated how the dependence on dollar reserves might be, let's say, a channel of vulnerability for countries operating in dollars.

So naturally, both style of countries, due to the US, started to, or tried to, accelerate it's the de-dollarization process. Russia itself had since the Crimea, invading of Crimea, Russia itself had written off some of their reserves with the Federal Reserve and diversify them and put them into Euros and particularly Chinese renminbi and so on.

So it was already a process taking place in the case of Russia, but of course, the sanctions give a new impetus for not only Russia but also other countries to ditch the dollar.

Otaviano Canuto, Former Vice President, the World Bank

The sweeping US sanctions on Russia, in the wake of the Russia Ukraine war sent a warning to the rest of the world about the risks of the US using the dollar as a tool for geopolitical gain.

I think also the Russia Ukraine conflict is kind of the defining moment of de-dollarization because it shows an attempt by the United States to de globalize.

That is to say that the United States has long been a beneficiary of globalization by, for example, attracting foreign talent from India. China, the former Soviet Union and so on, using globalization to its advantage to diversify economically, which was a major advantage to it and when it was experiencing stagflation in the 1970s, in the late 1970s, to the 1980s.

And now it is attempting to weaponize globalization by de-globalizing Russia. And of course, this is a major problem for the United States because Russia, of course, being the largest country by territory in the world, we can assume probably has a lot of natural resources, which of course it does.

And so this poses a major problem to the global economy when the United States and its European partners Australia, Japan, and so on, are trying to butt Russia out of the global economy.

Bradley Blakenship, Journalist

The Russian invasion of Ukraine in February of 2022 triggered a wave of US led financial sanctions against Moscow.

The two most powerful actions being the decision by Western governments to freeze nearly half of Russia's foreign currency reserves and the removal of major Russian banks from SWIFT, an interbank messaging service which facilitates international payments.

How can the role of US sanctions and the weaponization of the dollar be assessed in this situation?

I think that the thing that is very important for a global reserve currency like the US dollar is currently is to be apolitical. That means it must not be ideologically driven or politically driven, but we can see that the US dollar is now a political weapon ever since it became the world's reserve currency following the Second World War.

So before that, as I mentioned before, the US leaned into globalization, if the US Dollar was not being weaponized.

But we see in the unilateral moment that the United States had at the end of the 20th century and beginning of the 21st century, they started to adopt unilateral sanctions with their partners, their lieutenants in Europe, Australia and so on, as I mentioned before, and this is creating a very serious problem for the US dollar where it is now not apolitical, which means it is unfit to be a global reserve currency.

And now we're seeing countries try to avoid these unilateral and illegal, I should mention, under the United Nations Charter, illegal sanctions that are crippling countries like Iran, Cuba, Russia and so on.

The US is shooting itself in both of its feet by using the US Dollar as a weapon.

Bradley Blakenship, Journalist

Several countries are looking to move away from their dollar dependence, and China is promoting the Yuan as an alternative. China has become a major rival for the United States, a rivalry that is increasing on many levels.

What is the role of China in the current state of affairs?

China has already a strong weight on global trade and whereas less so, in financial transactions. I was at the board of the IMF as an executive director, when China was approved to have its currency as part of the SDR, the Special Drawing Rights, which is the accounting money produced by the IMF, that has at its base dollar, Euro, Sterling Pounds, Japanese Yen, and now China Yuan.

China complied quite well with the requisite in terms of size of trade but less so when it comes to financial transactions. And this is because China still resorts to capital controls that make the foreigners, let's say, less confident in storing their wealth in renminbi; and China knows this.

China knows and prefers not to dismantle the Capital controls that it has and tries to expand the presence of the RMB and in the ways that it can, which is basically through trade, particularly through bilateral treaties with countries and so on

Otaviano Canuto, Former Vice President, the World Bank

In February, the Central Bank of Iraq, a major oil supplier, announced that it will allow trade with China to be settled in the Yuan for the first time.

That same month, members of the China dominated Shanghai Cooperation Organization, the SCO, agreed to increase trade in their local currencies.

And in December, China and Saudi Arabia carried out their first transaction in the Yuan.

Since 2008, the Chinese had lost faith in the Americans' ability to responsibly manage the world economy and have been asking the Americans to cooperate with other countries on monetary policy, but they are not. Of course they are upping the interest rates, the Federal Reserve, without corresponding with other countries.

And we see that China is obviously unhappy with this because the losers in that situation are the American working class and developing countries, so this will hurt the global south, of which China is a major part, and the rise of China, and their larger seat at the table, is driving the de-dollarization of the world and we see also the rise of the Yuan and of national currencies across the across the world, including BRICS (which) is now discussing a basket of their national currencies.

Bradley Blakenship, Journalist

A weakening dollar would, of course, affect the US economy and increase inflation. America will certainly have to fight back against de-dollarization.

What is the reaction of Uncle Sam? And how far is Washington willing to go in this fight?

In terms of what the United States is going to do, there is a saying that the most deadly bite of the venomous snake, like the United States is, is the last one.

So it is the last bite of a dying snake, and so, the United States is going to bite into all it can and I think this will be in the form of warfare whether it be in kinetic battles, like through the proxy conflict in Ukraine, or enter a possible proxy conflict in Taiwan, to weaken Russia and China respectively.

I think also in terms of hybrid warfare through the media or through economic warfare like sanctions, continuing to impose sanctions and also getting its partners like the European Union, for example, to impose more sanctions on China.

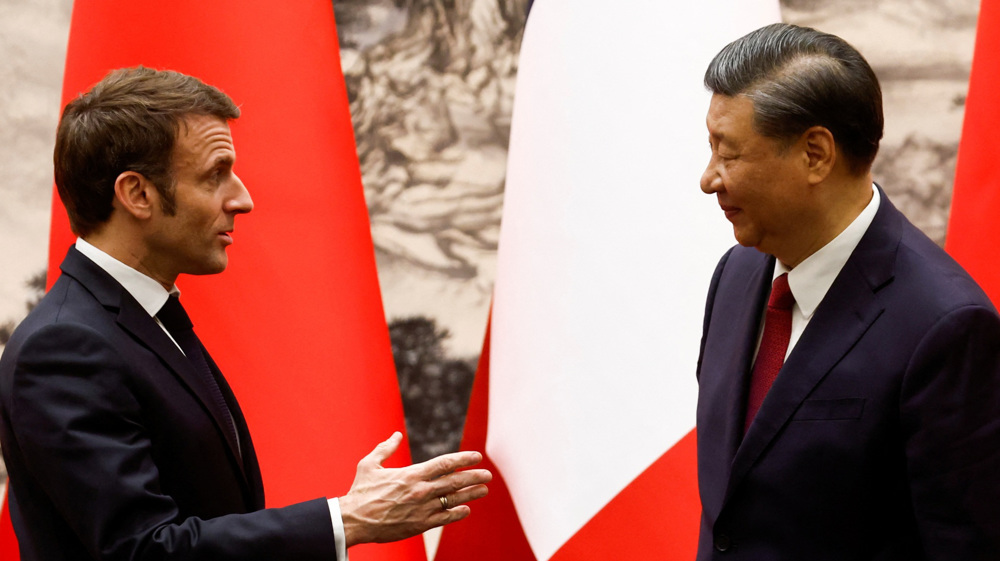

In fact, the European Commission President, Ursula Von Der Leyen, was just in China with French President, Emmanuel Macron, and she made [sic] a tweet saying that there is not a level playing field for European companies in China and that China is not open to Europe.

But this is actually not true because the Europeans and the Chinese already had a comprehensive agreement on investment that was agreed upon by the European Commission, agreed upon by the Chinese government, but it's languishing now in the European Parliament. It was not ratified.

This would be the largest investment agreement in world history probably, I would imagine in the values of several trillion probably, and it will be widely open up the Chinese market to European companies, but because of the influence of Washington in the European Parliament this is stowed away, it is languishing and it probably will never be passed, if European leaders have anything to say about it.

Bradley Blakenship, Journalist

Many would argue the US should not be worried about the depreciation of the dollar.

At the turn of the century, roughly 70% of the global currency reserves were in the US dollar, currently, despite all the talk about de-dollarization, It's just slightly below 60%. Meanwhile, the Yuan only makes up a meager 3%.

So perhaps the US can be complacent and arrogant about it.

The US might do [sic] to counter this relative loss of weight in international transactions. The demand for dollars will remain predominant in the world. So they don't have to. And there's not much that they can do if countries, bilaterally, or as [a] group of countries, decide to be less dependent on availability of dollar and establish agreements so as to use (an alternative to the US dollar) for trade transactions.

Otaviano Canuto, Former Vice President, the World Bank

Another important sign of the accelerated de-dollarization efforts is that various countries, including some of the US allies, have reduced their holdings of US debt to diversify their foreign exchange reserves.

Will the Europeans diversify their economic policies and are they willing to stand up to America?

There is this sector of the European elite which is deeply entrenched with Washington and is willing to sacrifice Europe, and the European population's best interests, for Washington. They are essentially the tail of the American Dog and they will do anything to uphold this even if it means the outright overthrow of their own governments and widespread chaos.

In fact, just in September, where I live in Prague in the Czech Republic, there was [sic] tens of thousands of people marching against their governments foreign policy, and asking for the resignation of their government, because of the inflation here that's now over 16% year on year, the latest employment report that we have from March.

I believe that this sector will not go out without a fight. But there is a rising and very prominent sector of European politics and, in fact, grassroots movements, in Europe which want to stand up for their own best interest [sic], and they do want to be a distinctive pole within the emerging multipolar world.

And I think that it is very hard to speculate on which of these two sides will win. However, I think that material conditions, material reality, that is the economic realities on the ground, will dictate this. I believe that the elite that are embedded with Washington, it will be impossible to maintain this because the population of Europe cannot endure the economic hardships that they are having right now.

Bradley Blakenship, Journalist

In an announcement that made global headlines the presidents of Brazil and Argentina said in January that they would set up a common currency to settle trade transactions.

China and Brazil have already signed an agreement on trade in mutual currencies, abandoning the US Dollar as an intermediary and are also planning to expand cooperation on food and minerals.

In the case on Brazil and China, for instance, Brazil has typically a trade surplus with China. And China has become the major trade partner for Brazil in terms of destination of exports and so on.

So naturally Brazil will tend to accumulate reserves in renminbi, which would be useful for the bilateral transactions with China.

And similar reasoning must be happening in the case of the relationship between the euro zone and China.

Otaviano Canuto, Former Vice President, the World Bank

China has been Brazil's largest trade partner for more than a decade, with bilateral trade hitting a record $150 billion last year.

The country has also reportedly announced the creation of a clearinghouse that will provide settlements without the US Dollar as well as lending in national currencies.

According to Brazil's Ministry of Finance, 25 countries are already making settlements with China in the Yuan.

Can Brazil be a partner in the de-dollarization trend?

I think that Brazil absolutely can be a partner in this. In fact, you know, Brazil has, before the Bolsonaro regime took power earlier in this decade, Brazil under Lula when he was president the first time that was when Brazil established BRICS. That is when, in fact, Brazil was leading the peace efforts through the UN in the Iraq War.

And now we have news that Brazil and China are going to present a peace plan for the Ukraine conflict between April 11 and April 15 of this month. So I think that with Lula as president of Brazil, Brazil is returning to its natural place as one of the most important countries in the world.

Let's remember that Brazil is one of the largest countries in the world. In fact, it is the maps that we have that greatly, you know, the Mercator map that we have greatly plays down the fact that Africa and Latin America are absolutely massive regions in the world.

Brazil is larger than the continental United States. It is a massive country with massive amounts of natural resources. It is a rich country, but it is a purposely underdeveloped country that has been at the foot of American imperialism for quite some time.

With Lula as president Brazil will go back on its track of becoming a more prominent and important country in international affairs and I do believe that Brazil can play a very important role in de-dollarization, because of that, because of Lula's ascendancy to the presidency again and the Brazilian people's decision to go in this way.

Bradley Blakenship, Journalist

Last year, Saudi Arabia and China announced that officials are in talks to price some of the Gulf nations’ oil sales in Yuan rather than dollars.

The two countries have been in discussions about Yuan priced oil contracts since at least 2016, but have advanced recently on the back of growing Saudi concerns over Washington's commitment to the kingdom's security.

Any move to conduct oil transactions with China in the Yuan will mark a profound shift in the energy market.

Yeah, Saudi Arabia has aligned this now after Xi Jinping visited Riyadh and it has aligned with China's Belt and Road Initiative.

So because of Washington's weaponization of human rights concerns, which I believe is a very real concern in Saudi Arabia, of course. But now, for so long the United States had ignored these concerns, but is now focusing on these showing its own hypocrisy because Washington, ... I know I'm an American citizen, I lived there for 22 years, I can tell you the human rights situation in the United States is absolutely atrocious.

People are being killed in the streets by police every day.

The United States is one of the only OECD countries, the only one in fact that I know of that does not have universal higher education or universal health care for its citizens. It is leaving the American people in destitution, over half, about 63% of Americans are estimated to live paycheck to paycheck. People are living in utter destitution in that country.

And so the United States wants to use human rights to criticize any other country while it commits human rights abuses.

It has a torture den in Guantanamo Bay, it had the torture camp in Abu Ghraib, it is spying on people all over the world through its Five Eyes network; we know this through the Edward Snowden leaks.

And yet it can sit here and criticize countries like Saudi Arabia or Iran or Russia or China for alleged human rights abuses. Even though in my opinion, these concerns in Saudi Arabia in particular are of particular value. I do think that there are concerns there.

Bradley Blakenship, Journalist

While the fact that the dollar remains the most frequently used currency in the world today will not change in the foreseeable future, the trend that more and more countries will consider non dollar currencies is also unchangeable.

But history does tell us that the decline of hegemony often begins with its currency.

Iran will continue hitting enemy targets in region: Judiciary chief

Israeli army admits failure to intercept Iranian missiles: Report

Global business rocked by fallout from US-Israel war on Iran

No security as long as US keeps military bases in region: Qalibaf

Iran ‘awaiting’ arrival of US forces in Strait of Hormuz: Military official

US intelligence says ‘regime change’ not possible in Iran even with broader war

IRGC targets US-operated oil tanker with suicide drone

US, not Iran, began attacking civilian infrastructure, Araghchi warns

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website