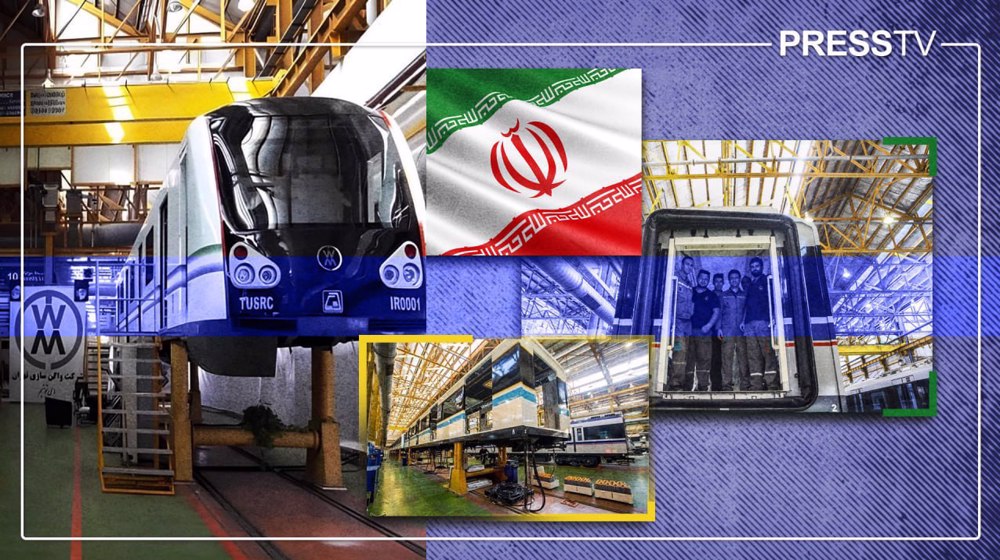

Fast track: Iran rolls out locally-made metro trains, driving self-reliance and eyeing global exports

By Ivan Kesic

The recent entry of two domestically-produced national metro train sets into Tehran's service cycle marks a significant milestone in Iran's strategic push for industrial self-sufficiency and urban traffic solutions, heralding a new era for the country's rail transportation industry.

Iran's urban landscape is being reshaped by a determined national initiative to achieve self-reliance in the production of metro rolling stock, a program that stands as a cornerstone for both economic development and the alleviation of critical traffic congestion.

The recent inauguration and operation of two national metro train rams in the capital, as announced by city officials in early December 2025, symbolize the tangible progress of this long-term strategy.

This event is the latest result of a systematic, multi-year effort to localize manufacturing knowledge, expand production capacity, and build a resilient industrial ecosystem.

By transitioning from heavy dependence on foreign imports to establishing a robust domestic manufacturing base, Iran is addressing the urgent need for efficient public transportation in its expanding cities while fostering technological advancement and job creation.

The development of a homegrown metro car industry represents a synergistic solution to the intertwined challenges of urban mobility, economic resilience, and technological sovereignty, setting a foundation for future growth and potential export ambitions.

Traditional dependence on foreign tech and imports

Before the launch of its domestic production initiatives, Iran's metro systems, particularly in the capital Tehran, were heavily reliant on foreign technology, imports, and international partnerships to meet their rolling stock requirements.

This dependence was largely centered on cooperation with Chinese state-owned rail manufacturing giants. For years, companies such as CRRC Corp. Ltd. and Norinco International were key suppliers, involved in both direct exports and technology transfer agreements.

A significant 2015 contract, valued at approximately $1.3 billion, was signed to supply around 1,000 subway cars from China for the Tehran Metro.

Furthermore, joint ventures were established, such as the one between Norinco, CRRC, and Tehran's subway operator, which not only supplied finished cars but also managed large-scale infrastructure projects like the construction of Tehran Metro Line 6.

Ambitions for technological diversification also extended to European partners, notably evidenced by a 2017 memorandum of understanding (MoU) with France’s Alstom company, which envisaged a €1.2 billion investment in Iran’s Arak Pars Wagon complex for manufacturing and technology transfer.

However, these cooperation agreements with Western companies were ultimately suspended in 2018 following the reinstatement of unilateral US sanctions by the Trump administration, which severely constrained Iran's access to Western finance and technology.

While these international collaborations provided essential vehicles and contributed to initial industrialization efforts, including later phases where assembly was shifted to Iranian factories, they also underscored a technological and supply chain dependency that proved vulnerable to external political pressures.

The domestic manufacturing capability at the time was largely limited to body fabrication and interior fitting, with critical subsystems like propulsion, braking, bogies, and door mechanisms sourced from abroad.

This import-reliant model highlighted the strategic vulnerability and foreign exchange costs associated with sustaining and expanding the national metro fleet, thereby setting the clear impetus for the subsequent drive toward indigenization and self-sufficiency.

From established wagon production to advanced metro systems

Iran possesses a long-established and substantial industrial base for the production of railway rolling stock, with a historical output that underscores significant capacity in freight and conventional passenger carriages.

The country's largest producer, Wagon Pars, has a manufacturing history dating back decades, with cumulative production totals reaching approximately 12,000 freight wagons and 400 passenger coaches as of recent estimates.

This legacy is supported by a network of other domestic firms contributing to a steady flow of domestically made wagons, with regular fleet deliveries often numbering in the hundreds annually.

However, the technological leap to designing and producing modern metro carriages represents a more demanding challenge, moving beyond this established metal-bashing and assembly capability.

While intercity passenger coaches prioritize comfort and cruising speed over longer distances, metro wagons are engineered for a radically different operational regime.

They must endure intense, high-frequency stop-and-go cycles, necessitating advanced and robust traction, braking, and propulsion systems.

Their complexity is further amplified by the stringent integration of sophisticated subsystems like automatic train operation (ATO), communication-based train control (CBTC), and compatibility with platform screen doors, all within strict space constraints and under rigid safety standards for fire resistance and passenger evacuation in underground environments.

Therefore, Iran's recent achievement in localizing over 85 percent of metro car production, including these critical systems, marks a qualitative advancement from its historical strength in conventional wagon manufacturing, entering a tier of higher technological integration and systems engineering.

Strategic imperative for domestic production

The expansion of Iran's major cities, particularly Tehran, has generated an immense and growing demand for reliable, high-capacity public transportation.

With six operational metro systems and two more under construction, with a total length of over 550 kilometers and ridership of over one billion per year, Iran is ahead of all major European countries in all these statistics.

These metro systems serve as the arterial network for millions of citizens on a daily basis, and their efficiency directly impacts urban productivity, air quality, and quality of life.

Historically, meeting the demand for rolling stock relied significantly on international partnerships and imports, which presented challenges related to currency exchange, long-term supply chain dependency, and adaptability to local specifications.

The strategic decision to pursue domestic production emerged from the recognition that a sustainable urban transit solution required a parallel development of indigenous industrial capability.

This approach aligns with broader national objectives for economic resilience, aiming to retain capital within the domestic economy, build technical expertise, and create a controllable supply chain for critical infrastructure components.

National train project: A foundation for localization

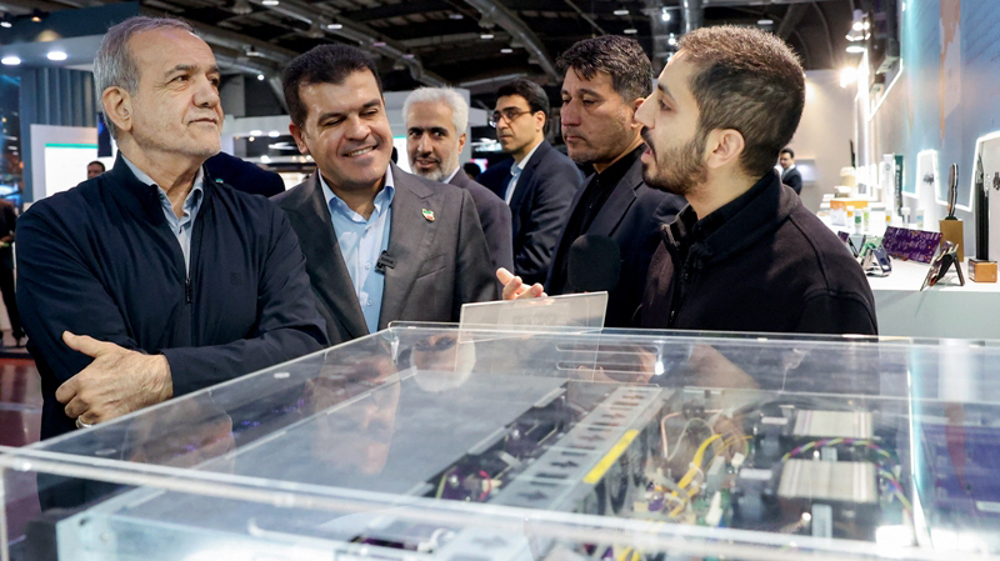

The formalization of this strategic vision materialized through the National Train Set Project, initiated in 2019 under a collaborative framework involving the Iranian Vice-Presidency for Science and Technology and Knowledge-Based Economy, Tehran Municipality, and a consortium of domestic knowledge-based companies.

The project's core mission was to indigenize metro car technology, systematically increasing the share of locally manufactured components.

The first operational prototype, unveiled in 2021, demonstrated an 85 percent localization rate, a substantial improvement from the previously achievable less than 30 percent domestic content.

This prototype underwent an extensive testing regime, encompassing over a thousand hours of tests across 16 distinct stages, to ensure compliance with international safety and performance standards.

The successful validation of this design and its subsequent entry into service on lines such as the Tehran-Parand extension (Line 1 Branch) provided the necessary confidence for authorities to approve the transition from prototype development to serial production.

Building an Industrial ecosystem: Collaboration and capacity

The production of a modern metro train is a complex endeavor that integrates numerous subsystems, including propulsion and braking, climate control, and door mechanisms.

High localization rates necessitated the orchestrated collaboration of Iran's existing industrial base.

A specialized working group brought together major manufacturing entities such as the MAPNA Group, Academic Center for Education, Culture and Research (ACECR), Sadra Fan Company, Tivan Rail Brake Company, and the Tehran Wagon Manufacturing Company, supported by over 25 knowledge-based firms.

This collaboration assigned specific technological challenges to each entity, fostering specialization and knowledge transfer.

For instance, MAPNA's Wagon Pars subsidiary assumed responsibility for bogie production, a critical and complex component, while other partners focused on propulsion systems, braking, and heating, ventilation, and air conditioning (HVAC) units.

This distributed model has effectively cultivated a domestic supply network, transforming isolated manufacturing capabilities into an integrated industrial ecosystem for rail transportation.

Expansion of manufacturing infrastructure and capability

To support the ambitious production targets, significant investments have been made in expanding and modernizing physical manufacturing infrastructure.

The Tehran Wagon Manufacturing Company complex has undergone a substantial transformation, increasing its production and paint hall spaces by 44 percent.

The introduction of advanced manufacturing technologies, including welding robots imported for the first time into the country, has enhanced precision and efficiency.

The company's site is undergoing a physical expansion that will double its covered space to approximately 10 hectares, accommodating new assembly halls, body production lines, and bogie manufacturing facilities.

This expansion is designed to support a dual-track production strategy, handling both the assembly of wagons from international contracts with high local content and the full-scale manufacture of the national train sets.

The nominal production capacity has now reached a level where the delivery of at least two wagon rams per month is achievable.

Economic and urban mobility impacts

The domestic production of metro cars generates multifaceted positive impacts for Iran's economy and its vibrant and rapidly growing cities.

Economically, the program is a significant job creator, with estimates indicating the generation of approximately 12,000 direct employment opportunities in its initial phases, alongside further indirect jobs within the supply chain.

The localization effort also results in considerable foreign exchange savings. Officials estimate a reduction of around 700,000 to 720,000 euros in costs per car compared to fully imported alternatives.

For urban mobility, the increased and reliable supply of rolling stock is pivotal. Each new train set entering service directly increases the carrying capacity and frequency of metro lines, which in turn reduces reliance on private vehicles, alleviates traffic congestion, and contributes to improved urban air quality.

As noted by city officials, enhancing the metro fleet capacity is a direct and effective strategy for addressing the problematic traffic congestion and pollution in the capital.

Broadening the horizon: From Tehran to other cities

The success of the national train platform in Tehran has laid the groundwork for its application in other Iranian cities, demonstrating the project's scalability and national relevance.

MAPNA's Wagon Pars has already signed a contract to design, produce, and test three complete train sets for the Qom metro system, representing the first fully domestic metro build for an Iranian city outside the capital.

The modular design of the national train platform allows for adaptation to different requirements, such as the development of five-car train sets tailored for the metro systems of cities like Isfahan, Tabriz, and Mashhad.

This nationwide applicability ensures a sustained demand pipeline for domestic manufacturers, justifies continued investment in research and development, and promotes standardized, maintainable transit solutions across the country.

The domestic industry is also positioning itself to meet a significant projected demand, with estimates suggesting a need for up to 1,500 metro cars in Tehran alone and substantial additional requirements from other urban centers in the coming decade.

Future development and strategic implications

With series production now approved and operational, the focus extends toward consolidating gains and exploring new frontiers.

The immediate production pipeline includes plans for 15 seven-car train sets and one eight-car set, with a long-term vision that envisages the production of up to 1,000 subway cars within the next five years through combined national and collaborative international contracts.

The strategic goal within the national wagon project is to reach 85 percent domestication, a target that is already being realized.

This growing expertise and scale of production have begun to foster discussions about Iran's potential role as an exporter of metro wagons and related technical and engineering services.

The development of in-house capacity for designing, testing, and manufacturing rolling stock according to international standards creates a foundation for the country to eventually offer its products and knowledge to regional markets, transforming a sector once dominated by imports into a potential source of export revenue and international technical cooperation.

The development itself represents a strategic alignment of industrial policy with urgent urban development needs, marking a definitive shift in the country's rail transportation sector.

This transition from prototype validation to authorized serial production exemplifies a convergent response to parallel demands for industrial growth and enhanced urban mobility, an achievement characterized by the integration of domestic scientific knowledge, collaborative project management, and the establishment of a structured industrial ecosystem involving major manufacturers and knowledge-based companies.

This integrated approach has successfully transitioned the national train from a demonstrative concept to a serially produced reality now entering daily service, strengthening the country's industrial base, conserving foreign currency, and providing a scalable solution to urban transportation challenges.

The program's design inherently supports scalability, evidenced by its ongoing adaptation for metro systems in other Iranian cities beyond Tehran, and aligns with quantified forecasts for rolling stock demand across the country's urban centers.

The continued execution of this initiative sustains contributions to skilled employment, capital retention, and the systematic augmentation of public transportation infrastructure.

Ultimately, the accumulated expertise and standardized production processes form a foundational platform that promises not only to enhance urban mobility for millions but also to solidify technological autonomy and economic resilience in a critical field of infrastructure engineering, with significant potential for future evolution into broader technological, industrial, and export-oriented spheres.

Tehran goes national: Iran has launched two domestically built train sets, with plans to produce 1 car per day, reduce pollution, boost metro efficiency, and showcase Iran’s self-reliance 🇮🇷.

— Press TV 🔻 (@PressTV) December 13, 2025

Follow: https://t.co/B3zXG74hnU pic.twitter.com/qh5XY6h1rU

Export potential and long-term market projections

Once domestic demand is met in the coming decade, Iran's mature metro car manufacturing industry is poised to enter the export market, targeting non-Western regions where demand for urban transit solutions is projected to surge.

Global market analysis indicates significant growth in the metro and rolling stock sector outside of North America and Europe, with the Asia-Pacific region expected to dominate.

Estimates suggest the total addressable market for metro cars and related rolling stock in these regions could reach approximately $20 to $28 billion USD by 2030.

This figure is projected to grow substantially, potentially reaching $30 to $40 billion by 2035 and escalating toward an estimated $40 to $55 billion by 2040.

Key growth drivers include rapid urbanization and new metro projects in Asia, particularly in China and India, alongside the expansion of transit networks in West Asia, Africa, and Latin America.

Iran's competitive advantages, including proven manufacturing capability, a high degree of parts localization reducing costs, and experience in operating within regional logistical and technical environments, could position it to capture a share of this multi-billion dollar market.

This export potential represents a logical next phase for the industry, transforming a strategic domestic program into a source of foreign revenue and international technical cooperation, further leveraging the foundational investments made in technology and human capital.

US offers Ukraine 'strong' security guarantees amid unsettled territorial row

Iranian researcher wins gold at Silicon Valley invention festival for cancer medicine

Turkey excluded from Gaza conference in Doha due to Israeli veto: Report

Protests against Trump administration continue

Three policemen killed in shootout with terrorists in southeast Iran

Hamas’s Khaled Meshaal urges Trump to abandon Israel-first policy

VIDEO | Iran FM in Minsk on first leg of Belarus, Russia tour

VIDEO | Press TV's news headlines

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website