US banks dropping like flies, threat to economy

US bank failures are occurring at an unprecedented rate, worrying bank depositors and investors indicative of another financial crisis is on the horizon given the unstable state of the US economy.

Sounding the bell at the US stock market is symbolic of a stock market which is performing well; however, this is not a reflection of the US economy.

Warning signs of a stark future abound in the US banking sector.

Trading was halted in shares of two more US lenders.

Regulators had to step in after PacWest and Western Alliance shares plunged.

Although there was optimism in Wall Street after stocks in the banking sector jumped on Friday, following a good jobs report and strong Apple earnings, there are still fears and worries about the sector, compounded by the failure of four midsize banks since early March.

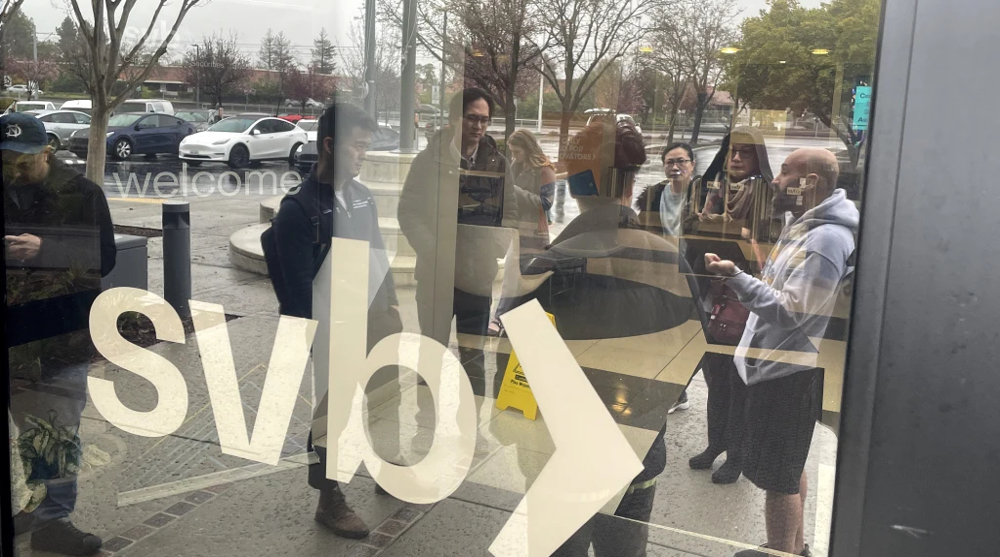

Bank customers and investors fear a repeat of other bank failures in the US such as First Republic, SVB and Signature; and those fears are justified.

As many as 16 midsize banks have shed more than $57 billion dollars in market value since last Friday.

American regulators seized then sold First Republic Bank to JPMorgan Chase on Monday, marking the second largest ever US bank collapse and the third major bank shutdown nationwide in the past two months following the collapse of Silicon Valley Bank or SVB, and Signature Bank.

Today the Federal Reserve issued its long awaited report on the cause of the Silicon Valley Bank failure and while we put the failure squarely in the hands of management and its board for failing to oversee a safe and sound business plan.

The Fed did put some heat on itself that its own bank regulators did not respond quickly enough and forcefully enough to conditions on the ground and these conditions also are conditions that First Republic faced.

V. Gerard Comizio, Associate Director, Washington College of Law

Are we witnessing a repeat of the US financial crisis?

Since 2001 more than 500 banks across the US have closed; most happened after the 2008 financial crisis.

Of all the banks that have closed since 2001 the largest was Washington Mutual, which closed in September 2008 during the early stages of the financial crisis.

The closure of First Republic marks the second largest bank closure in the US, and the largest since the end of the financial crisis.

But what stands out for those that believe that there is another financial crisis in the making is the fact that about seventy banks across the US have closed over the past decade.

The total assets of the three banks closed this year exceeded the total assets of the 25 banks that closed in 2008; consequently, the scale of US Bank closures in 2023 is the largest in years.

In this case you had a group of banks here that did not plan well for interest rate risk. They did not plan well for the big growth, explosive growth.

They didn't plan for what they should be planning for and that is a liquidity event, where you have more than ordinary numbers of withdrawals, especially given their levels of uninsured deposits.

That's a problem and so, you know, the chickens have kind of come home to roost for all these banks.

V. Gerard Comizio, Associate Director, Washington College of Law

The three banks, namely First Republic, Silicon Valley Bank, and, Signature Bank, held a total of $532 billion in assets, more than the $526 billion when adjusted for inflation, held by the 25 banks that collapsed in 2008 and at the height of the global financial crisis.

There are major factors that are affecting the health of US banks. One of them is the recent fed hikes.

In March 2023, a study jointly released by economists from multiple universities in the US, showed that the Fed's rate hike greatly increased the vulnerability of the US banking system.

Just as they were stubborn and obstinate on the idea that inflation was transitory, they're being stubborn and obstinate on the idea that they need to hit 2% inflation before they let up on the tightening, and that's simply just,... history doesn't bear it out.

And unless and until they come to that realization by studying history, you're going to see more and more of these situations.

Thomas Hayes, Great Hill Capital, Founder

Affected by the Federal Reserve's aggressive interest rate hikes, the value of financial assets, such as the bonds held by many US banks, has shrunk sharply; the asset value of some banks has decreased by more than 20%.

According to the study, if market confidence continues to weaken, and more depositors withdraw their deposits, as many as 186 banks may become insolvent and face the risk of closure, which should be a major concern for the Fed and the man at the top, US President Joe Biden.

Another item of concern for the US administration is the US debt ceiling.

As it stands, the Biden administration remains at odds with Republicans who had refused to increase the debt ceiling unless concessions were made.

MAGA Republicans in Congress are threatening to undo all this progress by letting us 'default on the debt' unless we agree to their demands.

The two are totally unrelated. Whether you pay the debt or not, doesn't have a damn thing to do with what your budget is, what your budget is, or where you're going to spend money, how are you going to raise the money?

What are you going to cut? There are two separate issues.

US President, Joe Biden

If the debt ceiling, which has reached its peak of $31.4 trillion, is not raised, it could potentially lead to a government shutdown on June 1st 2023.

The US government reaction so far, in terms of an intervention, has been subdued. According to The Sentry, even though US banks are failing, it is reported that US authorities are unlikely to intervene.

The reason given is that regional lenders, such as PacWest and Western Alliance, are not seen as systemically important and more consolidation is predicted.

The outlook, however, is bleak, unless the Fed comes to the rescue with cuts in interest rates.

The options are: amalgamation, regulation, or more banks going bust.

While the US is struggling with these economic issues, it is also facing the prospect of de-dollarization, which is gaining momentum since many countries are queuing up to join forces and wean their respective economies off the US dollar.

US missiles launched from residential areas of neighboring countries: Tehran

Pezeshkian: Nakhchivan aerial bombardment not linked to Iran

US, Israeli targets struck in mass IRGC missile, drone strikes

Supporting anti-Iran aggression constitutes complicity in war: Pezeshkian tells Macron

Iran Parliament hails election of new Leader, pledges allegiance

Iran's defense and security institutions unite in steadfast allegiance to new Leader

Profile: Ayatollah Seyyed Mojtaba Khamenei, third Leader of the Islamic Revolution

Resistance groups congratulate Iran on Ayatollah Mojtaba Khamenei’s election as new Leader

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website