Great Depression II: Collapse of banks exposes chinks in US financial system

By Syed Zafar Mehdi

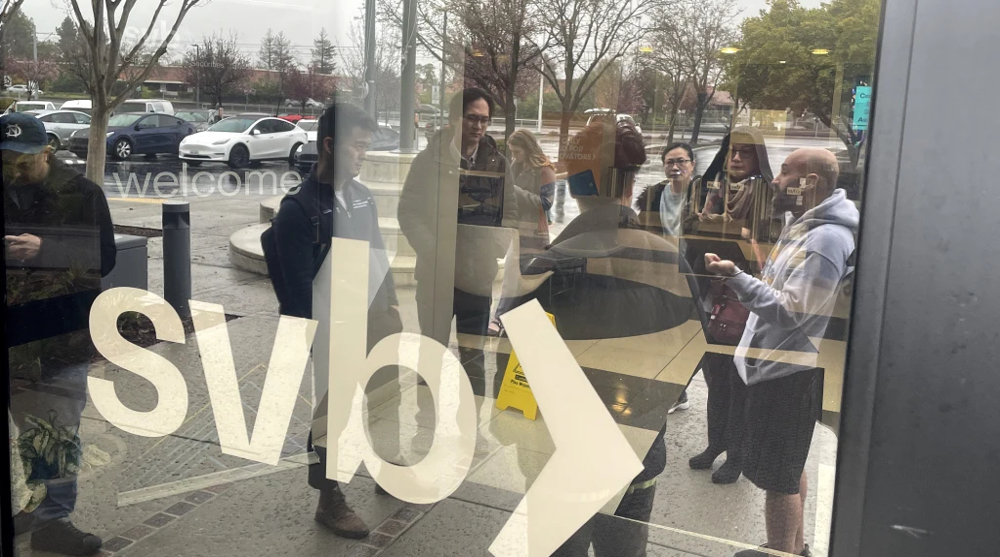

“Forbes curse strikes again,” a Daily Mail headline screamed on Tuesday, as Silicon Valley Bank, a venture debt provider supporting tech startups in the United States, careened off the cliff in a staggering fall.

The California-headquartered bank became the first high-profile American banking institution to fail since the 2018 financial crisis in a spectacular collapse that sent ripples of shock across the world.

Interestingly, the embattled bank made it to Forbes’ annual list of America’s best banks just weeks before federal regulators stepped in to shut it down and seized all deposits at the bank.

In a self-congratulatory and triumphal tone, the bank immediately advertised the feat on its social media handles and stressed that it had made it to the coveted list for five consecutive years.

“Proud to be on @Forbes' annual ranking of America's Best Banks for the 5th straight year and to have also been named to the publication's inaugural Financial All-Stars list,” SVB tweeted last Monday.

The Twitter page has since winded up and the website has also been taken down. “This account doesn’t exist,” the Twitter handle says.

Placed in 20th position, the Forbes list put the total assets of the SVB Financial Group founded in 1983 that owns the Silicon Valley Bank at $213 billion and efficiency ratio at 56, well above Massachusetts-based State Street Corporation and California-based First Republic Bank.

After the bank announced its bankruptcy, the magazine website added an editorial note on the ‘America’s Best Banks’ page, noting that the bank has since “collapsed” and been “placed under FDIC control on March 10 due to a bank run prompted by fears about its interest rate exposure”.

After the Silicon Valley Bank imploded, a New York-based crypto-centric financial institution, Signature Bank, also closed its doors on Sunday as regulators feared it would imperil the whole financial system.

Signature Bank had 40 branches, assets of $110.36 billion and deposits of $88.59 billion at the end of 2022, according to a regulatory filing, as reported by CNBC.

Now reports are emerging that the First Republic Bank, the 14th largest bank in the US that also made it to the Forbes list of ‘America’s best banks’ recently, could also be headed toward disaster.

Social media has been replete with posts over the weekend showing people queuing up before San Francisco-based bank’s branches in California to withdraw their money, igniting concerns among depositors that it could be the next to implode.

Before the latest wave of banking failures, starting with Silicon Valley Bank, Almena Bank based in Kansas and First Bank of Florida faced bankruptcy in October 2020 and were taken over by the FDIC.

Unlike the Silicon Valley Bank and Signature Bank, Almena Bank and First Bank of Florida were relatively smaller in size with about $200 million in deposits combined.

Silicon Valley Bank’s disaster is the worst since September 2008, when Washington Mutual with $307 billion in assets failed following the shocking collapse of investment bank Lehman Brothers.

President Joe Biden in a bid to restore confidence in the US banking system addressed Americans Monday about his government’s emergency plan to control the damage from the fall of two banks.

“Americans can rest assured that our banking system is safe. Your deposits are safe,” Biden said. “Let me also assure you we will not stop at this. We will do whatever is needed on top of all this.”

That, however, was not enough to pacify angry Republicans who accused the Democrat president of letting loose a multi-trillion dollar spending spree that fueled inflation and high-interest rates.

Some others lashed out at federal authorities for failing to pre-empt the collapse of Silicon Valley Bank, while Senator Bernie Sanders blamed a Trump-era policy for the simmering financial crisis.

“Let's be clear. The failure of Silicon Valley Bank is a direct result of an absurd 2018 bank deregulation bill signed by Donald Trump that I strongly opposed," Sanders wrote in a statement on Sunday, referring to the Economic Growth, Regulatory Relief, and Consumer Protection Act.

Biden also appeared to pass the buck to his predecessor, saying the last administration “rolled back regulations”. Trump hit back, saying Biden “will go down as the Herbert Hoover of the modern age”.

Economist Vidhura Tennekoon, in a syndicated article for AP, cited “interest rate risk” and “liquidity risk” as two key factors responsible for the current financial crisis facing American banks.

“The Federal Reserve has been aggressively raising rates – 4.5 percentage points so far – in a bid to tame soaring inflation. As a result, the yield on the debt has jumped at a commensurate rate,” she wrote.

“With over $1 trillion of bank deposits currently uninsured, I believe that the banking crisis is far from over,” she hastened to add.

Talk show host Stuart Varney argued that the Biden administration's enormous spending, the Federal Reserve's inflationary monetary policy, and terrible bank management precipitated the banking crisis.

“Backtrack a moment. Who is to blame for this? In my opinion, it is massive spending by the Biden team, and massive printing of money by the Federal Reserve, which created inflation, which pushed the Fed to the most rapid rise in interest rates in decades,” he said on his show Monday.

“Where are we going? Honestly, it's hard to say, the crisis is unfolding as we speak.”

The crisis didn’t come without a warning. In a detailed analysis published in The Atlantic in July 2020, California University law professor Frank Partnoy referred to “broken supply chains, record unemployment, failing small businesses” to warn of an impending banking crisis.

“All of these factors are serious and could mire the United States in a deep, prolonged recession. But there’s another threat to the economy, too,” he wrote.

“It lurks on the balance sheets of the big banks, and it could be cataclysmic. Imagine if, in addition to all the uncertainty surrounding the pandemic, you woke up one morning to find that the financial sector had collapsed.”

This is only the latest case of a banking failure in US history, but certainly one of the biggest. The history of bank disasters in the country dates back to 1819 after the Napoleonic Wars ended and the Second Bank of the United States found itself mired in a deep crisis.

The financial crisis of 1837 fueled the country’s worst recession that continued for at least a decade, forcing the complete closure of 343 out of 850 banks in the US and the partial failure of many others.

During the panic of 1873, known as the ‘Long Depression’, the New York Stock Exchange suspended its trading for the first time in history and many Americans were left penniless.

However, the official start of the ‘Great Depression’ was in October 1929 when the American stock market suffered a massive crash with the ‘roaring twenties’ being the main factor responsible. It led to a wave of banking failures ‘bank runs’ in the US between 1930 and 1932.

The Great Recession of 2008 marked the greatest economic downturn in the US since the Great Depression when two investment banks, Bear Stearns and Lehman Brothers, became bankrupt.

The latest financial crisis, experts believe, shows no American bank is big or strong enough to avoid a crisis.

Recent US military actions signal return to ‘predatory colonialism’: UN rapporteur

‘Confused clowns’: Iran FM blasts Zelensky over call for aggression on Iran

Trump drops Canada from Gaza board after PM Carney’s critique of US

Iranian students rally to condemn Germany's backing for rioters

Enemies of Ummah seek to expand war, Pezeshkian tells Erdogan

VIDEO | Press TV's news headlines

VIDEO | New wave of Israeli strikes on Lebanon as US suspends ceasefire mechanism

VIDEO | Israeli regime kills three more Palestinian journalists

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website