US govt. rules out SVB bailout, wants to avoid 'contagion': Yellen

US Treasury Secretary Janet Yellen on Sunday said the government wanted to avoid financial "contagion" from the implosion of the Silicon Valley Bank but ruled out a bailout of the institution.

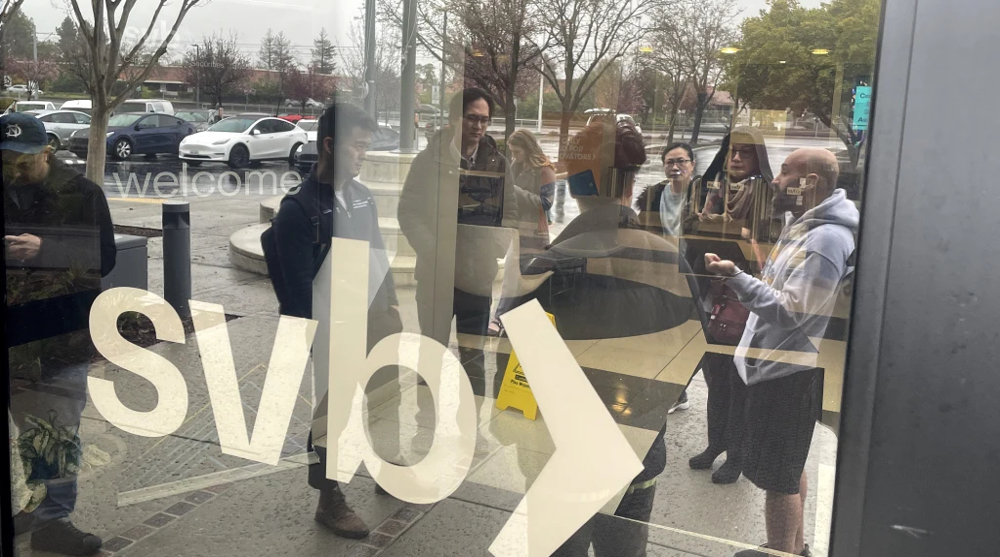

US regulators on Friday took control of SVB -- a key lender to US startups since the 1980s -- after a run on deposits made it no longer tenable for the medium-sized bank to stay afloat on its own.

Investors punished the banking sector in total on Thursday after SVB's disclosure the day before, but by Friday, shares in some larger banks posted gains.

However, regional lenders remained under pressure, including First Republic Bank, which slumped nearly 30 percent in two sessions on Thursday and Friday, and Signature Bank, a cryptocurrency-exposed lender, which has lost a third of its value since Wednesday evening.

In an interview with CBS Sunday, Yellen said the US government wanted "to make sure that the troubles that exist at one bank don't create contagion to others that are sound."

She added that the government was working with the US deposit guarantee agency, the FDIC, on a "resolution" of the situation at SVB, where approximately 96 percent of deposits are not covered by the FDIC's reimbursement guarantee.

"I'm sure they (the FDIC) are considering a wide range of available options that include acquisitions," she said.

Virginia Democratic Senator Mark Warner said in an interview with ABC on Sunday that the "best outcome" would be to find a buyer for SVB before markets open in Asia.

Futures contracts on the flagship indices of the Tokyo and Hong Kong stock exchanges were pointing to an opening decline of just under 2 percent.

No bailout

Since Friday, there have been calls from the tech and finance sectors for a bailout.

Yellen said that reforms made after the 2008 financial crisis meant the government was not considering this option for SVB.

"During the financial crisis, there were investors and owners of systemic large banks that were bailed out... and the reforms that have been put in place means that we're not going to do that again," she said.

Following the 2008 failure of Lehman Brothers and the ensuing financial meltdown, US regulators required major banks to hold additional capital in case of trouble.

US and European authorities also organize regular "stress tests" designed to uncover vulnerabilities at the largest banks.

SVB's implosion represents not only the largest bank failure since that of Washington Mutual in 2008, but also the second largest failure ever for a retail bank in the United States.

Little known to the general public, SVB specialized in financing startups and had become the 16th largest US bank by assets: at the end of 2022, it had $209 billion in assets and approximately $175.4 billion in deposits.

The company previously boasted that "nearly half" of technology and life science companies that had US funding banked with them, leading many to worry about the possible ripple effects of its collapse.

"Depositors, many of which will be small businesses, rely on access to their funds to be able to pay the bills that they have, and they employ tens of thousands of people across the country," Yellen said, adding that she was working with regulators to "address the situation."

The FDIC guarantees deposits -- but only up to $250,000 per client and per bank.

Earlier on Sunday, Britain's finance minister Jeremy Hunt warned that the country's technology and life sciences sectors were at "serious risk" following the SVB closure, noting that the bank manages the money of some of the UK's most promising businesses.

He added, however, that the governor of the Bank of England had made it "very clear" that there was no systemic risk to the UK's financial system due to the SVB's collapse.

The SVB turmoil has also spread to the cryptocurrency world.

Cryptocurrency USDC -- launched in 2018 as a "stablecoin," meaning it was indexed to a currency backed by a central bank -- fell sharply after the firm that created it, Circle, announced it holds $3.3 billion at SVB and has dropped its peg to the dollar.

Other stablecoins have also suffered, such as Dai and USDD.

(Source: AFP)

Oil surges past $100 a barrel as stocks tumble amid US-Israeli aggression against Iran

US does not care about security of regional countries: Tehran

India's muted response to US attack on Iranian ship betrays 'civilizational bond': Journalist

Israel used ‘white phosphorus’ in strikes on populated areas in Lebanon: Rights group

US missiles launched from residential areas of neighboring countries: Tehran

Pezeshkian: Nakhchivan aerial bombardment not linked to Iran

US, Israeli targets struck in mass IRGC missile, drone strikes

Supporting anti-Iran aggression constitutes complicity in war: Pezeshkian tells Macron

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website