Indonesia says following BRICS de-dollarization path

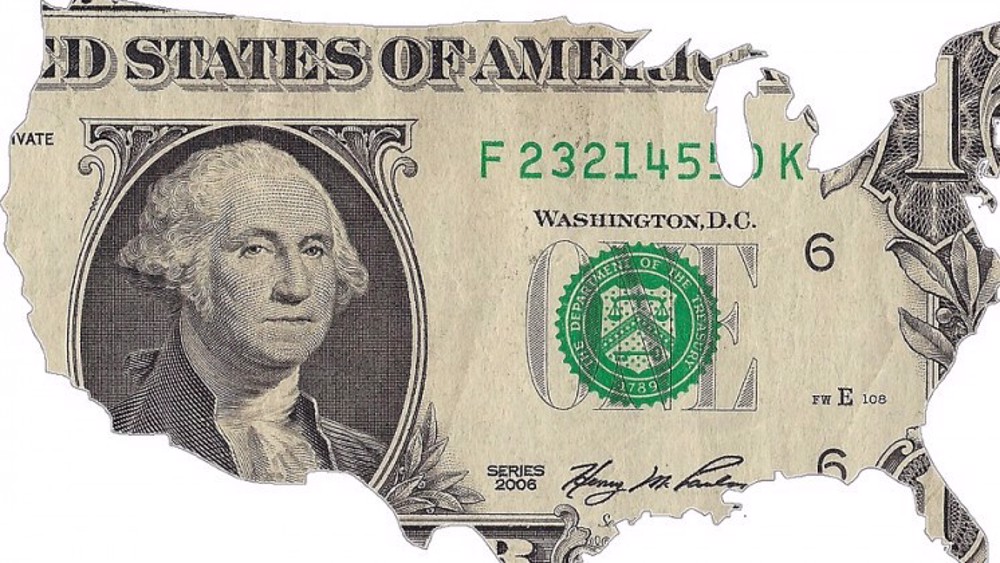

Indonesia has announced that the de-dollarization policy set forth by the BRICS economic bloc is making concrete progress, and Jakarta is following the lead of the bloc in its policy of shifting away from the US dollar.

The BRICS economic bloc -- comprised of Brazil, Russia, India, China, and South Africa -- announced that it is shifting away from the US dollar in trade and financial transactions.

In this regard, Indonesia with a GDP of $1 trillion, the largest in the region, is touted by analysts to be among the world's best trading partners.

“Indonesia has initiated diversification of the use of currency in the form of LCT [local currency trading]. The direction is the same as the BRICS. In fact, Indonesia is more concrete,” Bank of Indonesia Governor Perry Warjiyo was quoted as saying on Friday.

Speaking at a press conference at the board of governors meeting, Warjiyo said Jakarta had already implemented the practice with a number of countries, such as Thailand, Malaysia, China, and Japan, adding that it also planned to sign a cooperation agreement with South Korea regarding local currency trading in early May.

Meanwhile, BRICS member countries have been increasing the use of local currencies in mutual trade and also working on establishing a new reserve currency.

Russia, India, Brazil, and China have all signed agreements with other countries to trade in their own currencies, thus abandoning the greenback as an intermediary.

US Treasury Secretary Janet Yellen has admitted that economic sanctions used against countries by the United States put the dollar's dominance at risk.

As the United States has continued to weaponize the dollar, countries are seeking alternatives, from creating new common currencies to using local currencies.

Nations are trying to find a safe and equitable way to trade instead of being at the whims of a hegemony that can decide overnight to confiscate a country’s money or cut it off from the international financial system.

Russia launched its de-dollarization policy when the West slapped economic sanctions against the country.

After Russia launched its special military operation in eastern Ukraine in February 2022, the US led a massive wave of financial sanctions against Moscow.

The biggest moves were the decision by the West to freeze nearly half of Russia's foreign currency reserves and also the removal of major Russian banks from SWIFT, an interbank messaging service that facilitates international payments.

The backdrop of the sanctions introduced by Western governments against Russia, a major global energy producer and exporter, prompted China to decide to ditch the dollar in international trade, as well.

Bank of Russia records show that the Chinese yuan has become a major player in Russian foreign trade.

India, a major importer of Russian energy, has also taken several steps towards shifting away from the greenback to rubles and rupees in mutual trade with Moscow.

Canada prime minister hits back at Trump's remarks

Lebanese journalist summoned to court for criticizing president

‘The Voice of Hind Rajab’ receives Oscar nomination

VIDEO | Foreign-backed terrorism in Iran

US-backed riots suffered 'humiliating' defeat in Iran: Yemeni leader

Pezeshkian: ‘Unholy rage’ fueled by Iran’s enemies after June defeat

Iran condemns Israeli demolition of UNRWA headquarters in occupied al-Quds

Denmark reasserts Greenland sovereignty as Trump claims ‘total access’

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website