China's Xi calls for oil, gas trade in yuan on Persian Gulf visit

China’s President Xi Jinping has called for energy sales in the Chinese yuan, a move which would weaken the US dollar’s grip on world trade and establish yuan internationally.

Xi also said the Shanghai Petroleum and National Gas Exchange should be used by China and other countries to settle oil and gas trades in yuan.

China will establish bilateral investment and economic cooperation working mechanisms, carry out local currency swap cooperation and deepen digital currency cooperation, he added.

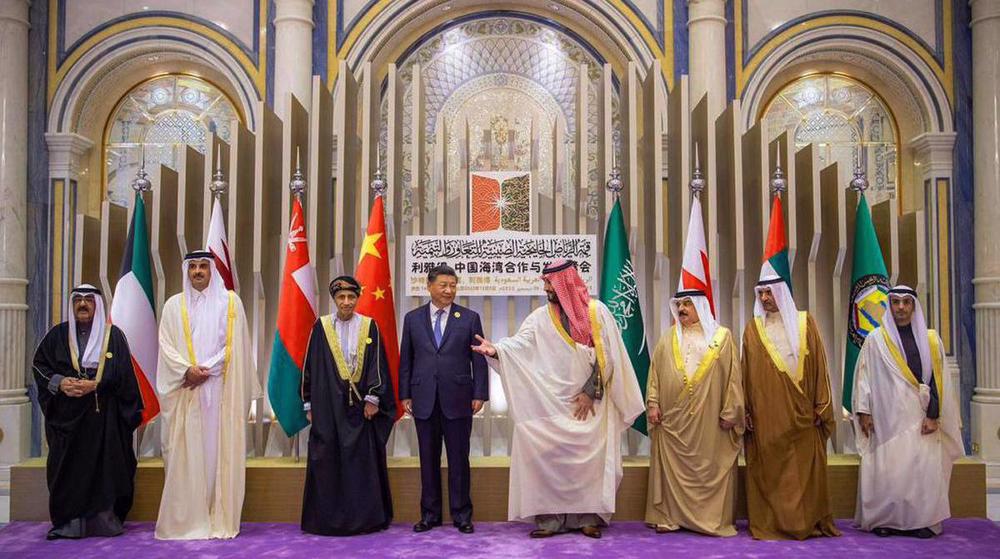

The Chinese leader made the remarks in his Friday address to the Persian Gulf Cooperation Council (GCC) summit hosted by Saudi crown prince Mohammed bin Salman (MBS) in Riyadh.

A Saudi source speaking before Xi's visit had been cited as saying that a decision to sell small amounts of oil in yuan to China could make sense in order to pay Chinese imports directly.

Any move by Saudi Arabia to ditch the dollar in its oil trade would be a seismic political move, which Riyadh had previously threatened in the face of possible US legislation exposing OPEC members to antitrust lawsuits.

China's growing influence in the Persian Gulf has unnerved the United States. Deepening economic ties were touted during Xi's visit, where he was greeted with pomp and ceremony and on Friday met with Persian Gulf states and attended a wider summit with leaders of Arab League countries spanning the Persian Gulf, Levant and Africa.

In March, the Wall Street Journal reported that Saudi Arabia was considering replacing the US dollar in favor of yuan in its oil sales to China.

An American senator then warned that China and Saudi Arabia’s potential ditching of the dollar in their bilateral oil trade could indicate a global shift away from the United States.

"Just this point of the Saudis pricing some of their commodity in Chinese currency or signaling that that’s where they’re headed, that is a big, bad thing," Ben Sasse told the Fox News.

A move to conduct oil transactions with China in yuan would mark a substantial shift for the oil market, where 80 percent of sales are conducted in dollars.

Saudi Arabia and its Persian Gulf allies have defied US pressure to limit dealings with China and break with fellow OPEC+ oil producer Russia.

Xi said Beijing would continue to import large quantities of oil from Persian Gulf countries and expand imports of liquefied natural gas.

China would also "make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade," he said.

Beijing has been lobbying for use of its yuan currency in trade instead of the US dollar.

Kata’ib Hezbollah asks fighters to prepare for 'war' in support of Iran

Israeli warplanes conduct new aggressions across southern Lebanon

Democrats threaten govt. shutdown after second ICE killing in Minneapolis

MSF to disclose limited list for Gaza staff after Israel revoked its aid licenses

VIDEO | India defies Western push at UN Rights Council on Iran

Cuba's president observes drills, vows high cost for any US aggression

Iran dismisses Nazi-style propaganda on riot death toll

Israel kills more civilians in Gaza amid relentless ceasefire violations

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website