Enrich at home, bully abroad: US tycoon tied to Trump, Israel builds private enrichment empire

By Ivan Kesic

While the Donald Trump administration continues its 'maximum pressure' policy against the Islamic Republic, calling for the dismantling of Iran’s peaceful uranium enrichment program, investments in private enrichment facilities within the United States are gaining momentum.

On July 25, a California-based company linked to American billionaire Peter Thiel, a prominent Trump supporter and a staunch Zionist, announced plans to establish the first privately-owned uranium enrichment facility in the US at a closed plant in western Kentucky.

General Matter revealed it would revive the defunct Paducah Gaseous Diffusion Plant. In an email to WKMS, the company framed the move as a major investment in US nuclear infrastructure, stating:

“Seventy-five years after the Atomic Energy Commission first chose Paducah for uranium enrichment, we're rebuilding this historic site to advance American energy independence.”

Rise of General Matter

General Matter was incubated within Thiel’s Founders Fund, the venture capital firm he co-founded, which has backed companies such as SpaceX, Palantir Technologies, and Anduril.

The company was created to reduce US reliance on foreign enriched uranium, particularly from Russia, which currently supplies 20–30 percent of the country’s nuclear fuel.

Thiel is listed as a director in General Matter’s business filing with the Kentucky Secretary of State, indicating his direct involvement in guiding the company’s strategic direction.

The initiative draws on expertise from SpaceX, Tesla, and the US Department of Defense, reflecting Thiel’s extensive network of technological and military talent.

Founders Fund partner Scott Nolan is a key figure in the project’s development.

The facility, formerly the Paducah Gaseous Diffusion Plant in McCracken County, Kentucky, was operational from the 1950s until its closure in 2013. It played a significant role during the Cold War, enriching uranium for both civilian and military applications.

General Matter plans to deploy advanced laser isotope separation technology, a more efficient alternative to traditional gaseous diffusion or centrifuge methods.

This approach is aimed at producing low-enriched uranium (LEU) for current nuclear reactors, and potentially high-assay low-enriched uranium (HALEU) for advanced reactors.

While investment figures remain undisclosed, the involvement of Founders Fund and possible US Department of Energy (DOE) loans – up to $2.7 billion – indicates a multi-billion-dollar undertaking.

The initiative aligns with the 2024 Prohibiting Russian Uranium Imports Act and seeks to reduce US reliance on Russian uranium, which currently generates 4-5 percent of US electricity. It also supports broader national energy security and climate objectives.

General Matter has been included on the DOE’s list of approved LEU suppliers and stands to benefit from tax credits under the Inflation Reduction Act’s 45X and 48C provisions.

This move reflects a broader US strategy to rebuild domestic enrichment capacity amid growing global demand for nuclear energy, projected to reach 623 GW by 2050, according to the International Atomic Energy Agency (IAEA).

The announcement comes amid rising geopolitical tensions, including Israeli aggression against Iran and the ongoing war in Ukraine, underscoring the strategic urgency of securing domestic uranium supplies.

Lucrative global market

The global uranium enrichment market was valued at approximately $10-12 billion in 2023, with enriched uranium comprising a significant portion due to its specialized and capital-intensive production process.

Projections indicate growth to $15-18 billion by 2030, with a compound annual growth rate (CAGR) of 4–6 percent, driven by the expansion of nuclear power and shifting geopolitical dynamics.

The International Atomic Energy Agency (IAEA) estimates that global nuclear power capacity will rise from 393 GW in 2023 to 623 GW by 2050, increasing demand for enriched uranium. High-assay low-enriched uranium (HALEU, 5-20 percent U-235) is particularly sought after for advanced reactor designs.

While current enrichment capacity exceeds demand, long-term shortages are anticipated by 2040 due to the emergence of new reactors requiring higher enrichment levels.

Enrichment output is measured in Separative Work Units (SWU), with global demand estimated at 50-60 million SWU annually. The process relies primarily on gas centrifugation (the dominant technology), while laser isotope separation is emerging as a more advanced alternative. Both methods require substantial capital investment and technical expertise.

Russia currently dominates the global market, holding approximately 40 percent of global enrichment capacity through its state-owned firm Rosatom. It supplies around 50 percent of the world’s enriched uranium fuel, creating significant dependence among countries operating Russian-designed reactors.

China controls about 17 percent of the market, driven by the China National Nuclear Corporation (CNNC), supporting its rapid nuclear expansion, including 55 operational reactors by 2023 and plans for 150 by 2035.

France accounts for 12 percent, with Orano leading the sector and benefiting from Europe’s reliance on nuclear energy (56 reactors) and export capacity.

The US contributes roughly 11 percent, down from 20 percent in the 2010s, largely due to privatization and the “Megatons to Megawatts” program, which repurposed Russian warhead uranium for civilian energy use.

US-based companies such as Centrus Energy and Global Laser Enrichment (a Silex Systems-Cameco joint venture) are working to rebuild domestic capacity, aiming for 5 million SWU annually by 2030.

Private investments in Western enrichment firms like Centrus are viewed as efforts to counter Russia’s market dominance, although critics argue this may fuel a new arms race, particularly as China expands its capabilities.

Another major player is Urenco, with a tri-national ownership structure comprising the Netherlands (8 percent), the United Kingdom (7 percent), and Germany (6 percent), totaling a combined 21 percent market share.

Private companies such as Urenco and Orano have faced criticism for prioritizing profits over safety, with underreported incidents at facilities like Capenhurst.

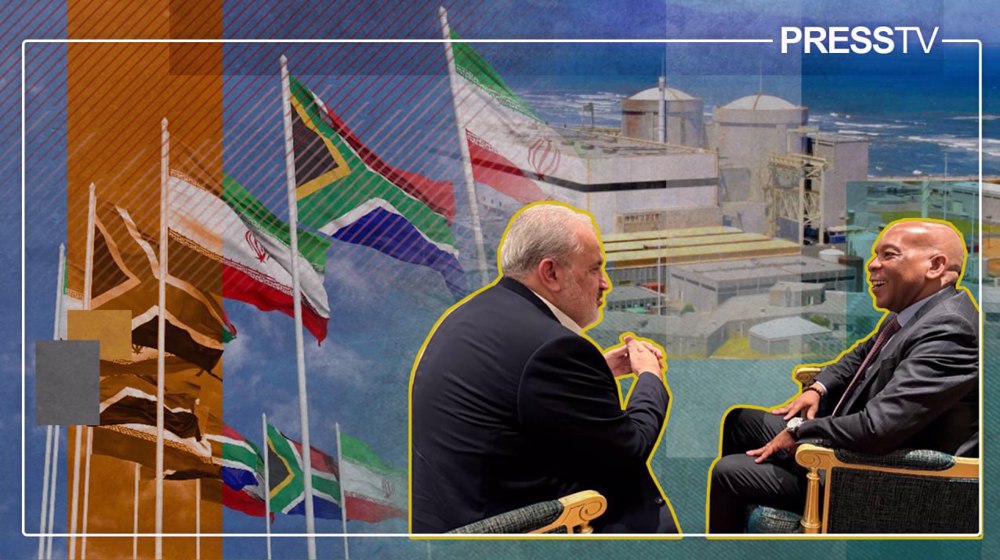

Emerging players in the enrichment market include Iran, which continues to enrich uranium for domestic use, and South Africa, which has announced plans to restart its enrichment facilities.

Both nations face significant political pressure. Iran faced unprovoked military aggression over its energy-driven enrichment, while South Africa is reportedly being blackmailed over its foreign policy, with the US refusing to deliver contracted uranium for its nuclear power plant.

Peter Thiel’s role

Peter Thiel’s connections with US policymakers and tech innovators, primarily through his venture firm Founders Fund, have facilitated the rapid advancement of the project, including negotiations with local officials such as Paducah Mayor George Bray.

His interest in nuclear technology reflects a broader pattern of investing in strategic industries with national security implications, consistent with previous ventures.

Thiel’s investment portfolio includes Palantir Technologies, which uses AI for defense and intelligence applications, and Anduril Industries, which develops autonomous weapons systems.

Both companies are highly controversial: Palantir has been implicated in supporting the Israeli regime's military operations in Gaza, while Anduril collaborates with Israeli firms such as Elbit Systems.

Thiel is also a backer of various pro-Israel tech initiatives through Thiel Capital and is publicly recognized as a vocal pro-Zionist advocate.

His involvement in the uranium industry also reflects a controversial family legacy. His father, Klaus Thiel, worked in uranium mining across South Africa and Namibia as a mining executive and project manager.

At the time, South Africa was under apartheid rule and pursued a short-lived military nuclear program, developed in close cooperation with the Israeli regime.

Iran will continue hitting enemy targets in region: Judiciary chief

Israeli army admits failure to intercept Iranian missiles: Report

Global business rocked by fallout from US-Israel war on Iran

No security as long as US keeps military bases in region: Qalibaf

Iran ‘awaiting’ arrival of US forces in Strait of Hormuz: Military official

US intelligence says ‘regime change’ not possible in Iran even with broader war

IRGC targets US-operated oil tanker with suicide drone

US, not Iran, began attacking civilian infrastructure, Araghchi warns

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website